MEDICAL

Resources

OUR MEDICAL PLANS

- Provide a wide range of health care services.

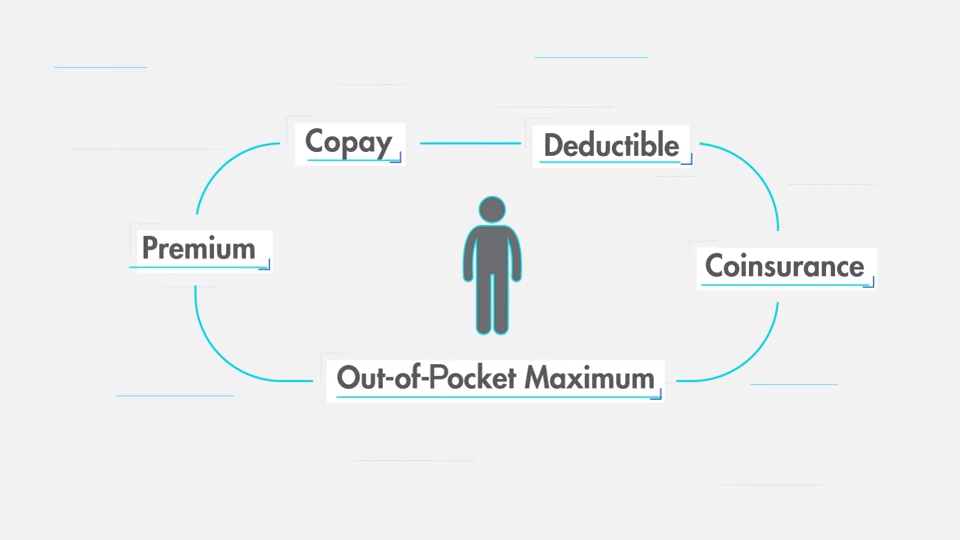

- Provide benefits for covered expenses after you pay a copayment or meet the applicable annual deductible.

- Offer network providers whose pre-negotiated rates will save you money.

- Allow you to use out-of-network providers, if you wish.

Learning as much as possible about the plans can help you make more informed choices regarding your needs and those of your covered dependents. Review the Benefits-at-a-glance chart. The chart will help you make an informed decision about the coverage that best meets your needs and those of your covered dependents.

YOUR OPTIONS FOR MEDICAL COVERAGE

Having access to high quality, affordable health care is a great concern for most people. We are pleased to offer team members and their families medical coverage through Medical Mutual. The company pays the majority of the cost of this coverage and offers three plan choices, an Enhanced Plan, Basic Plan, and HSA Plan.

Both of our plans provide high quality, affordable medical care, including doctors’ visits, preventive care, hospitalization and emergency care. Review the benefit summary comparison chart below to learn as much as possible about the plans.

HOW THE PLANS WORK

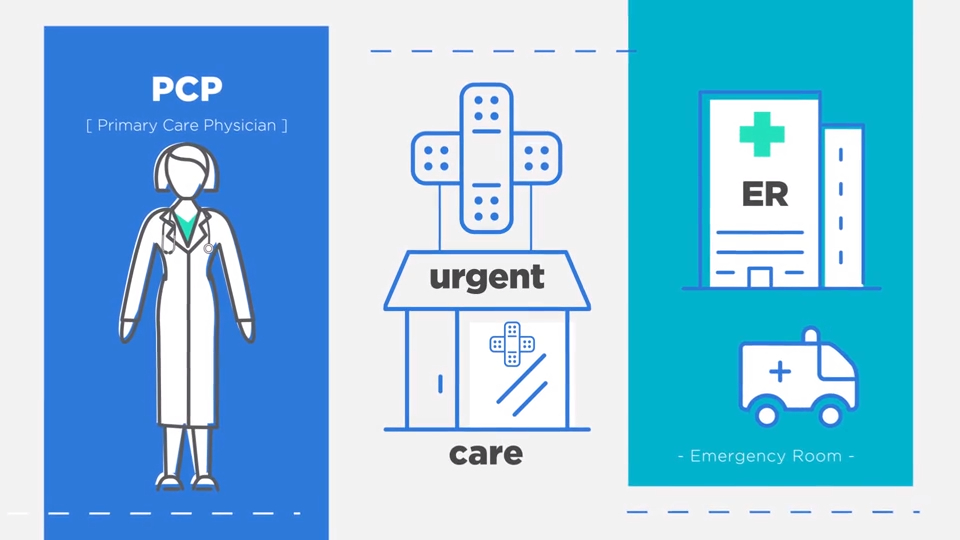

All three plans are part of the Preferred Provider Organization, administered by Medical Mutual. All give you freedom of receiving care within the network or from out-of-network providers. When you use providers within the network, the plans pay a higher level of benefits and you generally won’t have to file any claims manually.

If you prefer to go out-of-network for medical care, you will be reimbursed at a lower benefit level. You may also have to file a claim for reimbursement.

Please note: If a preferred provider refers you for covered services to another provider (such as a lab or specialist), make sure the provider you have been referred to is also a preferred provider. If the provider you use is not a preferred provider, your out-of pocket costs will be higher, even if you are referred by a preferred provider.

PRESCRIPTION DRUGS

When you enroll in a medical plan, you automatically receive prescription drug coverage. Coverage is provided through Medical Mutual for retail prescriptions and Express Scripts for mail order. If you have your prescription filled at a participating retail pharmacy, you may purchase up to a 30-day supply of covered drugs. At the participating pharmacy, you will need to present your ID card and make the required copayment. You may obtain information on participating pharmacies by visiting the Express Scripts site. The plan also includes a home delivery order service through Express Scripts. If you are taking a medication for an extended period of time, you can purchase up to a 90-day supply of covered drugs through Express Scripts, which will be delivered directly to your home (or your local RiteAid pharmacy). By using the home delivery program, you are able to get a 90-day, rather than a 30-day, supply.

If your Prescription Order is for a Prescription Drug that is available through the Home Delivery Prescription Drug program and you choose not to use the Home Delivery Prescription Drug program, you will be required to pay two times the appropriate Prescription Drug copayment indicated when your Prescription Order is refilled beyond the second time within a 180- day period.

To use the home delivery program, ask your doctor to give you a new prescription for up to a 90-day supply of your regular medication, plus refills, if appropriate. You will receive forms for refills and future prescription orders each time you receive a prescription from the homedelivery service. You can also re-order online at Express Scripts.

Enhanced Plan – Copayments for Prescription Drugs

Basic Plan – Copayments for Prescription Drugs

HSA Plan – Subject to Medical Deductible

MEDICAL BENEFITS-AT-A-GLANCE – ENHANCED PLAN

* Out-of-Network reimbursement is based on what the insurance carrier deems as reasonable & customary. You will be responsible for paying the difference between amount billed and reasonable & customary, in addition to the coinsurance levels above.

MEDICAL BENEFITS-AT-A-GLANCE – BASIC PLAN

* Out-of-Network reimbursement is based on what the insurance carrier deems as reasonable & customary. You will be responsible for paying the difference between amount billed and reasonable & customary, in addition to the coinsurance levels above.